Your will can save a life

What a gift in your will can do

It is a powerful act of generosity when you remember the University Hospital Foundation in your will. By planning your gift this way, you can create a legacy of care and innovation—often making a bigger impact than you ever imagined possible. It can also be surprisingly simple and have far reaching benefits, including:

- Offsetting income taxes to your family

- Extending your vision of the community into the future

- Honouring the values you hold beyond your passing

Sample will wording

The following are sample clauses, but we recommend consulting with a lawyer or financial planner before including a charitable organization in your will.

Tax benefits

Canada offers some of the most generous tax incentives for charitable giving in the world, making it easy for you to give.

Start your will with Epilogue

Leaving a legacy gift in your will has never been easier. We’ve partnered with Epilogue Wills – Canada’s leading online estate planning solution.

Charitable requests and gifts in your will

One of the meaningful aspects of a legacy gift is that it allows you to support the future—without affecting your finances today. You can bequeath a piece of property or other tangible assets, securities, cash, or even a percentage of your estate. Gifts made through your will can also lower, or even eliminate, taxes owed on your final estate!

A legacy of impact

What does leaving a legacy mean to you? For our community of legacy donors, it means shaping the future of healthcare through planned giving.

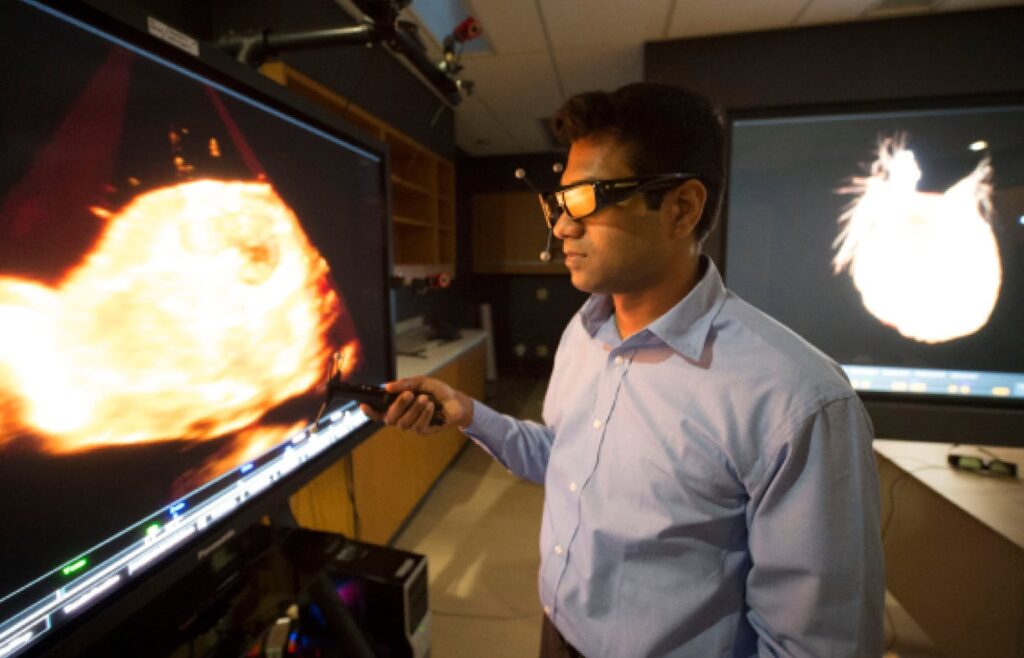

Donors who have left a gift to the Foundation in their will have already accomplished incredible things. Their contributions have allowed us to advance Gamma Knife radiosurgery, provide state-of-the-art cardiac care at the Mazankowski Heart Institute and so much more. Every donation has a ripple effect on the health ecosystem throughout Alberta, and beyond. When you plan your legacy gift, you plan for a better future with potential cures for people with Alzheimer’s disease, diabetes, organ failure, multiple sclerosis – and more.

Celebrating our legacy donors

At the University Hospital Foundation, we celebrate donors who have designated a donation gift in their will to the Foundation through our Gold Leaf Society. Along with ensuring donors’ gifts will never be forgotten, the Gold Leaf Society offers members-only events including special access to behind-the-scenes tours of parts of the hospital rarely seen by the public, and presentations from some of our world-leading healthcare teams.

If you are interested in learning more about how a gift in your will can help you achieve your legacy plans, please contact a University Hospital Foundation’s Philanthropy Officer for more information.